For the 14th year Korin Haight has been named a Five Star agent as featured in 5280, The Denver Post and Forbes Magazine!

IF you want to sell your home faster and for more money staging makes all the difference, from homey touches to furniture placement and beyond. We can help to make your home appeal to more buyers and sell quickly. Every showing should be a positive experience for the buyer so they fall in love and can’t live without your property. We always include staging in our 2% sell side listing fee.

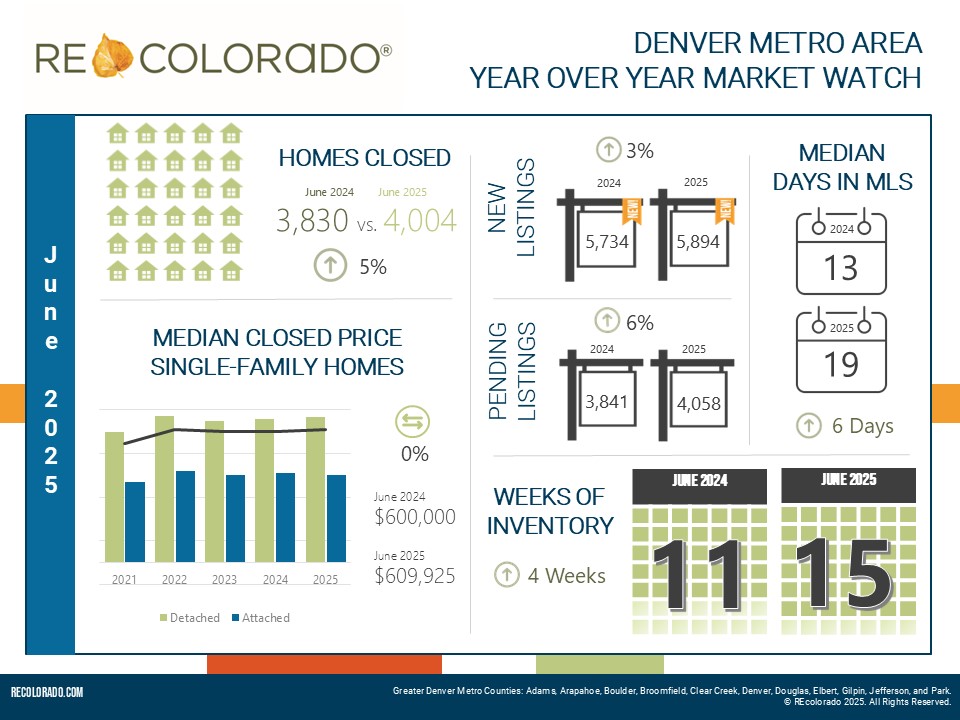

What is happening with the Denver market?

This is a snapshot of the latest market statistics.

Give me a call if you are curious and want more info on current market conditions.

Click below for more information

In 1997 I founded my company because I wanted to approach Real Estate in a manner different from the large Real Estate companies in Denver. Since my background was in the service industry, I made a conscious decision to do limited advertising to attract new clients. Instead I would rely primarily on word of mouth and referrals to attract new business. The result of this method is that I work with fewer clients than the average realtor, but my success rate is much higher. Using this method I am able to spend more time with each client.

Rave reviews

Contact Perfect Properties

Follow us

@perfect_properties_Denver